Protect your personal information wherever you go and your money wherever you pay. Nulink gives you advanced security and easy-to-use privacy controls so that you and your information stay safe every day.

NuLink offers two-step verification, Find My Phone and remote data erase.

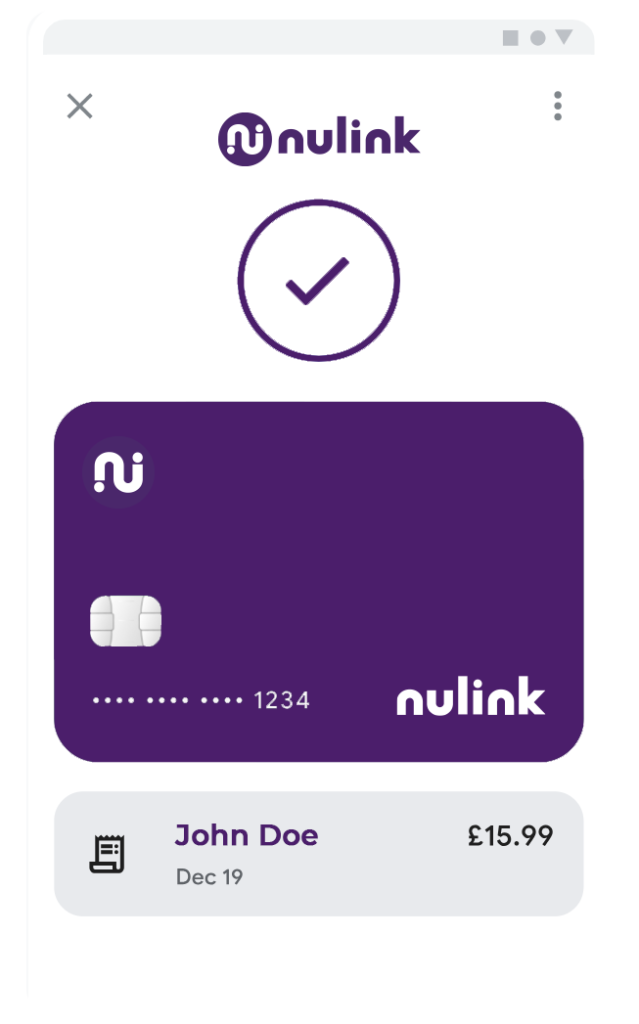

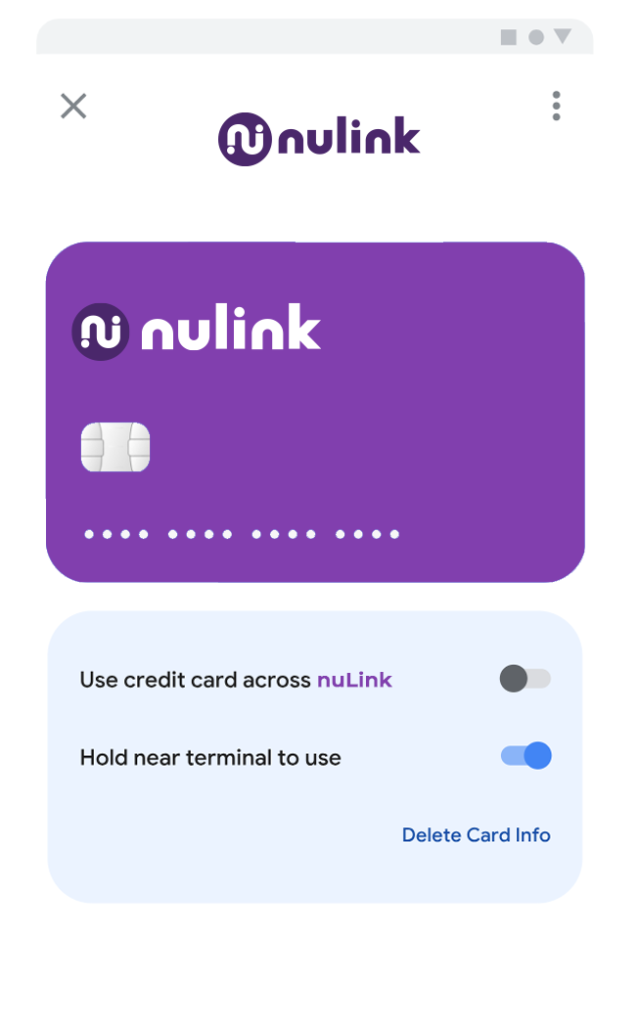

Api to pay uses encrypted payment codes to hide your real card number

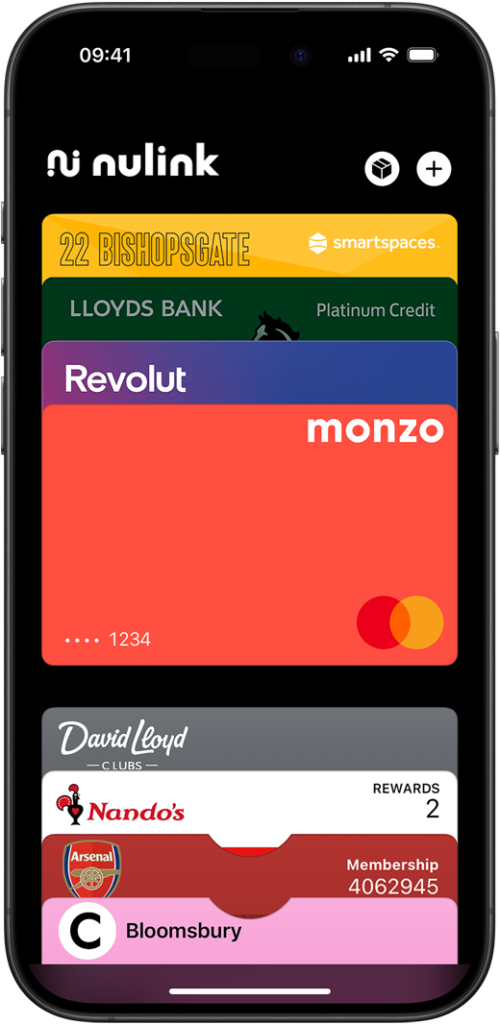

NuLink lets you choose the info that you share between products for a tailored experience

0.75% business transection fee , Accept payments anytime, anywhere from multiple payment apps, banks and more for free…

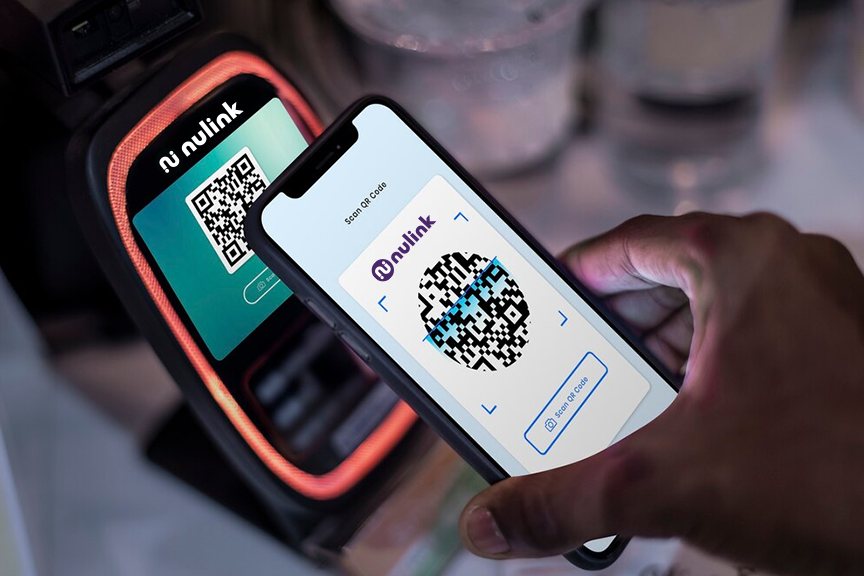

United Kingdom’s first All-in-One (Business API) payment service & QR device for merchants, business and more…

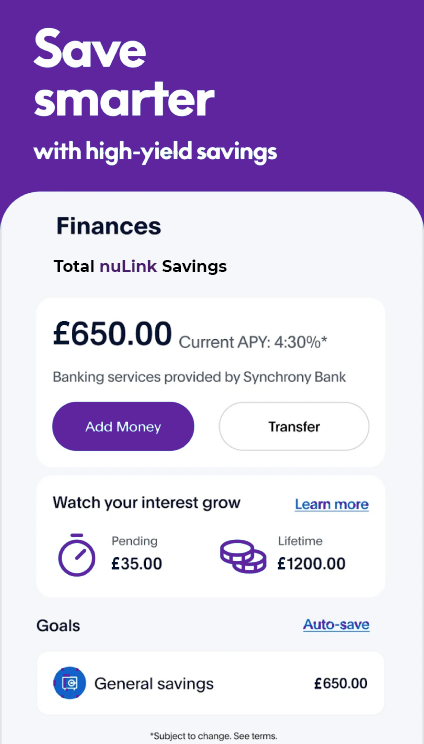

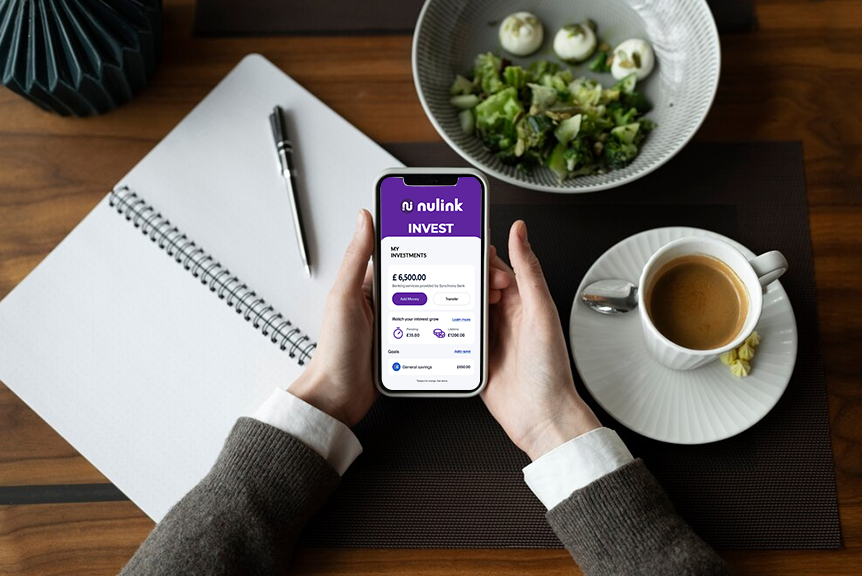

Invest with approved partners & earn more…

Collateral-free loans to fast forward your business growth , get Payday loan and pay daily auto

Nulink provides free API to integrate with your business software and APP.Get free business API to Integrate with Nulink Business

Now, scan and pay easily on any QR with NuLink UPI

Instant credit card bills payments made easy…

We offer payday short-term loan and salary advance loan to verified users

Save big with UK’s largest loyalty program

Earn industry leading returns at zero charges

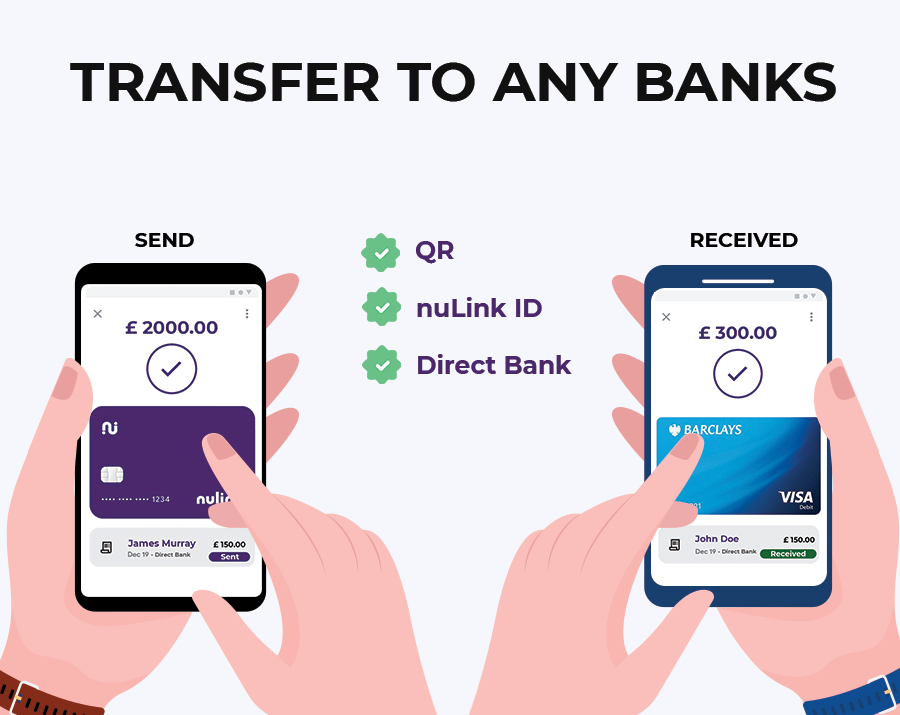

NuLink is a next-generation unified QR payment system in the UK, built to make digital transactions simple, secure, and efficient. With its advanced eWallet features, users can link multiple bank accounts in a single mobile app, giving them the flexibility to manage payments, receive funds, send international transfers, store loyalty cards, and even use QR UPI to pay anyone directly from their bank account. This all-in-one solution eliminates the need for multiple apps, making financial management seamless and user-friendly.

For businesses, NuLink provides a free Business API that ensures smooth integration across platforms. The NuLink API offers developers a comprehensive set of web services that allow them to embed NuLink’s powerful payment solutions directly into their applications. This enables companies to accept online payments, manage financial transactions, and streamline day-to-day operations with ease, ensuring global reach and reliability.

Beyond online transactions, NuLink also supports merchants with point-of-sale (POS) services across the UK, offering some of the best rates in the market. By combining online and offline payment solutions, NuLink empowers businesses of all sizes to handle financial operations more effectively while giving customers a fast, secure, and convenient payment experience.